Tutorial 28:

Help me understand Indirect Rates – I don’t get them!

In this tutorial we will focus on how to calculate indirect rates. Before beginning please take a moment to download the DOE document entitled Guidance for Indirect Rate Submission as well as the excel spreadsheets for one-pool, two pool, or three pool models; more on this later. Note that the pdf file has the names and phone numbers of contact people that you can call for assistance. Set these documents aside and have them ready to review later in this tutorial.

The Funding Opportunity Announcement (FOA) provides instructions for developing and submitting indirect rates and advises that indirect rate calculations be submitted in one of the following forms:

- If proposed rates are already approved by DOE or another federal agency, provide documentation of acceptance. Examples of “approved” indirect rate include:

- rates on a GSA schedule,

- Provisional billing rates,

- If proposed rates have been developed and are proposed on another DOE or government agency proposal (including subcontracts or subawards), provide documentation of how rates were developed. A statement should be made to the effect that an award as a result of this application will not change the rates proposed.

- If none of the above apply, provide documentation on how rates were developed for this proposal. Include any models used to calculate rate(s).

As discussed in Tutorial 26 documentation regarding indirect rates should be submitted as part of the Budget Justification form. Grantees are required to identify the indirect rate as a percentage and also include the indirect rate base amount, and a narrative description of the base. Care should also be taken to ensure the amounts entered on the project budget form are consistent with the figures provided on the Budget Justification narrative.

Let’s take a quick tour through the concept of Indirect Rates. The Federal Acquisition Regulations, referred to as the FAR provides a framework for developing indirect rates and also provides guidelines and principles on how rates should be organized. It does not however provide a universal model for calculating indirect rates. There are various ways to do this, referred to as the one-pool, two-pool, and three-pool structures.

The simplest example is the “one-rate” system, where direct costs are defined as those that were discussed in the budget justification. These are costs directly caused or in support of the grant objectives. Indirect costs, therefore, would be all other costs, including labor to administer and run business operations, fringe benefits, marketing and proposals, fixed costs of facilities and equipment, and other operational support not directly attributed to the grant. The “pool” in this case are all indirect costs. This is divided by all direct costs (called the base) to derive the indirect “rate.” Therefore, for every dollar you spend on a project (base costs), you add its proportional amount of support from the indirect pool by applying the rate. [See the demo for an example.] Take a look at the Indirect Rate Model – One Pool that DOE has provided. Remember that both the dollar amounts and the items included are examples and are NOT the amounts that you should put in. You must use the items and costs that are appropriate for your business.

There are a number of factors that go into selecting an appropriate rate structure. The first we will consider is the size of business, the types and number of contracts, and variety of costs. For professional services, such as for study contracts, a single rate system might be the simplest rate structure. If there is an STTR partner or consultants involved in performing a substantial portion of the study, then a two-rate structure might be more appropriate. On the other extreme, large prime contractors have unique indirect rate structures for every segment that may include dozens of “rates and factors.”

A second factor to consider when selecting an appropriate rate structure is the agency with which you do most of your work. Government agencies participating in the SBIR/STTR program can be divided into two general categories: Grant agencies and contract agencies. Grant agencies are those having a mission of funding state-of-the-art research, development, and technology for broad applications. Examples are National Science Foundation (NSF), National Institutes of Health (NIH), and the Department of Energy (DOE). Contract agencies like the DoD, DARPA, Homeland Security, and NASA are also interested in funding state-of-the-art research and development, but they follow a more focused outcome and employ a more rigorous contracting model. Grant agencies follow academic pricing methods, customs, and techniques. You’ll see fringe as a direct cost along with a single indirect rate used frequently in this environment. The generic standard indirect rate method seen for contract agencies is the two rate system of direct labor Overhead (OH) and General & Administrative rate (G&A). Both, along with their variations, are valid forms of calculating and proposing indirect rates. Take a look at the excel spread sheet that DOE provides entitled “Indirect Rate Model – Two Pool” and see if this best fits your needs.

The third consideration when selecting an indirect rate structure is your competitive position. You may need to “fine-tune” your indirect rate structure if you are in a highly competitive environment based on cost. Highly competitive pricing in government acquisitions usually applies to professional and technical services contracts or product manufacturing. In the SBIR/STTR acquisition environment, price is not the primary competitive factor. Prices are essentially set for all competitors. The primary competitive factor is the promise of the technology. Take a look at the excel spread sheet that DOE provides entitled “Indirect Rate Model – Three Pool” which is the most complicated of the indirect calculation approaches.

Businesses often ask – what’s a good rate structure. Unfortunately there is no magic answer to this question. Philosophically, a good rate is one that allows the small business to meet its obligations in its competitive environment while running and perpetuating its business. In terms of a DOE grant, it also assures the government receives good value for the awarded R&D project.

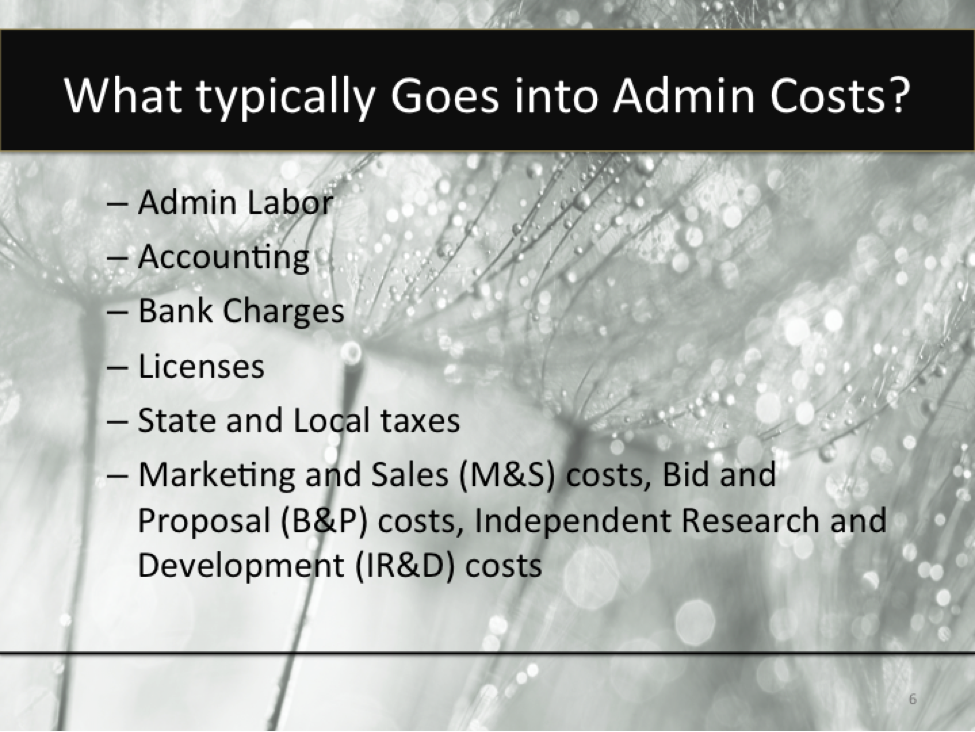

Let’s talk about what goes into the direct and indirect pools. A “pool” by the way refers to a way of clustering accumulated costs by type [direct, fringe, overhead, or general and administrative]. Payment for indirect expenses is then spread across, or allocated to small business operations providing the direct billing based on the relative proportion of revenue each business line provides to the whole.

The DOE asks the applicant to provide a model showing how you derived your indirect rate(s). The model does not necessarily have to be the DOE model provided in the application instructions. The model you provide however, should include all the details addressed in the DOE model, including the types of costs proposed, and the base of each rate calculated. The grantee should be prepared to use the figures from their model to fill out the indirect cost information on the budget form and the narrative on the Budget Justification form – not those provided in the example.

The FAR lists a number of costs and rules for their treatment. The following is a listing of many of the costs commonly included as indirect costs:

Facility (fixed) costs commonly include

- Depreciation & Amortization

- Equipment/Furniture Lease

- Property insurance

- Janitorial

- Network Charges

- Office Expense

- Office Lease/Rent

- Postage & Shipping

- Printing

- Property Taxes

- Repairs & Maintenance

- Telephone

- Utilities

- Auto Expense

Engineering Indirect Costs

- Labor

- Conferences/Seminars

- Lab Expenses

In addition, these costs can be allocated to a cost pool, being sure that you follow the FAR guidelines appropriately:

- Business Meetings

- Conferences/Seminars

- Consultants

- Contract Labor

- Dues & Subscriptions

- Legal Costs

- Recruitment

- Relocation

- Training

- Travel

- Travel Meals

The FAR also lists a variety of costs the government is prohibited from paying for either directly or indirectly. The major ones are:

Non-allowables

- Advertising

- Alcohol

- Bad Debts

- Charitable gifts/donations

- Entertainment

- Fines & Penalties

- Interest

- Lobbying

- Reorganization

- Federal taxes

- Travel costs over government per diem rates

The ability to include indirect costs provides your company with an opportunity to spend in strategically important financial areas:

- Improve technical capabilities

- Improve business systems in anticipation of a Phase 2 award

- Increase Bid and Proposal, Marketing efforts, or Internal Research and Development o IR&D projects

The government views these costs favorably as a way to expand your business base, thereby stabilizing and possibly reducing your indirect rates. This is where the art of developing indirect rates comes in. Since you likely won’t be able to rely on the business base with a Phase 1 effort to support all your operational desires, you’ll be faced with a variety of choices and tradeoffs on what you can afford.

Quiz: Tutorial 28: Help me understand Indirect Rates - I don't understand!

1

Where in the Federal Acquisition Regulations (FAR) can cost principles be found?

Nice Work

Try Again

2

What would not be considered a direct cost?

Nice Work

Try Again

3

Which of these costs are allowable according to FAR Part 31?

Nice Work

Try Again

4

What does the term “pool” refer to?

Nice Work

Try Again

5

Which cost structure is commonly used in academia?

Nice Work

Try Again