Tutorial 27:

Completing the Budget Justification Form

The purpose of this module is to assist you in preparing the Budget Justification form submitted as part of your DOE SBIR or STTR application. Before starting this tutorial it is important that you download the Budget Justification form from DOE’s website. Otherwise you won’t be able to follow this tutorial. To get there quickly please use the Links tool that accompanies this tutorial. Once you are on the DOE website, navigate to Applicant and Awardee Resources. There, you will find the Budget Justification form roughly in the middle of the page. I will then walk you through the process of completing the Budget Justification form. As we begin to work our way through this, it will become apparent why you cannot leave work on the budget until the last minute.

A phrase that you will frequently see in the budget justification form is “basis for the cost estimate.” This overriding theme requires that you identify, itemize, estimate, and justify costs. Be sure to attach any supporting documentation used for justification. The form suggests that if an element on the form is not applicable, that you should mention that it is not applicable, rather than just leaving that section blank. Also be sure that the cost figures that you provide in the Budget Justification form are consistent with those in your proposed budget pages. Let’s start on the first page of the Budget Justification form.

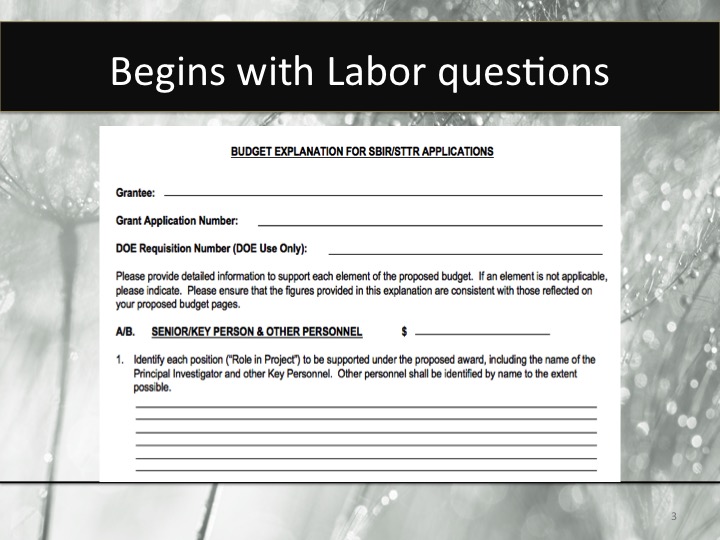

The first section you must complete is the Labor section – You are asked to Identify each position (“Role in Project”) to be supported under the proposed award, including the name of the Principal Investigator and other Key Personnel. Here be sure to identify by name and job title those individuals within your organization who will be supporting the program. If individuals are not yet hired, identify each by his or her labor category (for example, Sr. Electrical Engineer).

Briefly justify the need for each individual proposed. (Note: If your budget includes any proposed labor that is primarily administrative or managerial in nature, particular effort should be made to support such labor, as these positions are not customarily proposed or recorded as direct labor charge.) Typically administrative and/or managerial tasks are part of your indirect rates. However, the Principal Investigator can include the effort to manage the program in the direct labor budget. Producing reports typically falls within direct labor, unless administrative help is required.

You are also asked to state the number of hours to be expended, and the hourly labor rate, for each position proposed. Don’t overthink this. A work year typically contains 2,080 hours. To determine the hourly rate you take the base salary and divide that by 2,080 – This will give you the hourly rate. If people work part time and are paid on an hourly basis, then you have what you need. In addition you will need to estimate the number of hours they will work. Be sure that the information that you put in the budget explanation form aligns with the SF424 budget form.

You are also asked to Identify the basis for the labor rate(s) proposed and to explain why it is reasonable for the market (e.g., education, skills, experience, salary survey, etc.). Please note it is not sufficient to state only that the proposed compensation is an individual’s actual salary; however, that should be addressed.

The easiest way to validate a labor rate is through payroll. A pay stub goes a long way in “proving” a labor rate. If you can, provide pay stubs for those working the project. Even if you haven’t paid yourself, consider running a payroll, even if it’s for a limited number of hours or a short period.

Justifying the reasonableness of labor rates can sometimes be time consuming. However, a place to begin is with the Chamber of Commerce for the area in which you will be hiring to see if they have conducted salary surveys. You might also contact professional associations and ask the same question or contact the Bureau of Labor Statistics. Salary surveys will provide you with the basis for stating that the labor rates are consistent with those paid in that geographic location, for your size of business, and for your particular industry. Provide whatever information you can to validate these statements:

The next section deals with FRINGE BENEFITS – The form states If separately proposed, indicate the basis for the rate used or the computation applied, including the types of benefits to be provided. If the rate or computation protocol used has been approved by a Federal agency, provide a copy of the agreement.

We recommend that fringe benefits not be proposed separately unless you have done so in the past and/or have an approved fringe rate. More on this will be discussed later in the demo that accompanies this tutorial.

Let’s move on to the section on Equipment – As you recall from Tutorial 23, equipment is defined as an article of tangible, nonexpendable, personal property, including exempt property, charged directly to the award, having a useful life of more than one year and an acquisition cost of $5,000 per unit or more. Items of equipment to be leased or purchased must be described and justified in this section. Title to equipment purchased under this award lies with the government. It may be transferred to the grantee where such transfer would be more cost effective than recovery of the property by the government.

As you can see the Department of Energy will allow the purchase of equipment with its approval. The budget justification is fairly self-explanatory. Make it a point to suggest you only need the equipment for this project and any potential follow-on Phase II work.

You are then asked to Briefly itemize and justify the need for each item of equipment to be purchased. Indicate the estimated unit cost for each item to be purchased. Provide the basis for the cost estimates (e.g., vendor quotes, catalog prices, invoices, past experience purchasing similar or like items, etc.). Attach any written vendor quotes, catalog pages, etc., supporting the proposed cost.

Then we move on to Travel – It’s customary to use the Federal Travel Regulations (FTR) found on the GSA website to determine per diem rates for lodging, meals and incidentals for a specific geographic location. These should be used when determining travel costs. http://www.gsa.gov/portal/content/104877

Airfare should be estimated at the lowest available price. It’s relatively easy to get both airline quotes and rental car quotes. You may also consider adding in personal mileage (using GSA rates), airport and hotel parking, and other fees.

Under the subheading “Other Direct Costs” there are numerous items – with the first being, Materials and Supplies –

- It’s best practice to develop a Bill of Material (BOM) file, or listing of all materials and supplies needed for the project.

The next sub-item is Publication Costs -

- Itemize publication cost estimates by type/nature of expense. Provide the basis for cost estimates or computations (e.g., vendor quotes, prior purchase of similar or like items, etc.). Remember that if you are going to publish in a journal article you will need to review the criteria for Data Management Plans in Tutorial 14.

The next item is Consultant Services – As defined at FAR 31.205-22, consultant services (i.e. professional services) as those services by persons who are members of a particular profession or possess a special skill that the contractor does not possess internally.

You are asked to Identify the individual/firm proposed and the professional services to be provided.

ADP/Computer Services (i.e. IT)

- IT costs are commonly provided as an administrative cost and are part of the indirect rate pools. However, under certain circumstances, advanced computing services may be required from a specialized source. The guidelines again make it apparent that you need to provide vendor quotes, or relevant information from prior purchase of similar or like services, etc..

The next major section is Subawards/Consortium/Contractual Costs (Including Research Institutions and any Other Subcontractors

Subawards are distinguished from consultants in that they include more than just “professional services.” A subaward may involve a number of specialized services plus testing, inspection, or fabrication. Your STTR partner would be considered a Subaward. The five sections under Subawards ask you to describe, quantify and justify the need for this support.

Be aware that there are special pricing approval rules involving the use of DOE National Labs on an SBIR/STTR award. Your review comments on the subaward should address and substantiate the following:

- Was the subaward competed or a market survey performed? If so, what were the factors in selecting the subawardee? (e.g. skills are unique to this company/institution to get the work completed)

- Are the hours proposed adequate or reasonable for the effort described?

- Are the labor rates within what you might pay for similar services?

- Are other non-labor costs justified with a vendor quote or other objective evidence?

Equipment or Facility Rental/User Fees

Different cost element, same type of questions. As with IT, leading-edge services may be required from a specialized source. However, equipment costs should not be excessive – less than 10% of the award) and should be required to perform the research. In cases where equipment costs are high, justification should be provided showing that there were no rental or leasing alternatives available for equipment

Briefly itemize and justify the need for each item of equipment or facility to be rented or otherwise utilized. Indicate the estimated unit cost (rent or user fee) for each item of equipment or facility. Provide the basis for the cost estimates (e.g., vendor quotes, catalog prices, invoices, past experience with similar or like items or facilities, etc.). Attach any written vendor quotes, catalog pages, etc., supporting the proposed cost.

Other – List items by major type and provide justification for the proposed cost (e.g., vendor quotes, prior purchase of similar or like items, etc.).

The last part of the Budget Justification deals with Indirect costs. In order to address this section adequately, please review the demo associated with Tutorial 27.

Quiz: Tutorial 27 - Completing the Budget Justification Form

1

Which of the following is NOT an element of a Basis of Estimate for proposed costs?

Nice Work

Try Again

2

An hourly labor rate should be calculated as follows:

Nice Work

Try Again

3

Where would you find government approved per diem rates for travel?

Nice Work

Try Again

4

What is the weakest basis for an estimate of any cost?

Nice Work

Try Again

5

What’s an appropriate indirect rate?

Nice Work

Try Again